If you’ve ever been at-fault in an accident or committed a serious traffic violation, you likely carry Sr-22 insurance. While technically not coverage, the Sr-22 is proof that a driver is carrying at least the minimum amount of auto insurance. In many cases, drivers who commit serious violations such as speeding (20+ mph over the limit), driving impaired or driving recklessly end up ordered by a court to carry Sr-22 insurance. Of course, after a court orders a driver to obtain the Sr-22 coverage they will be hit with the cost of Sr-22 coverage. And depending on the violation a driver commits, the cost could sky-rocket. The goal for this post will be to give drivers an estimate for what common violations could do to your insurance costs.

What’s the damage

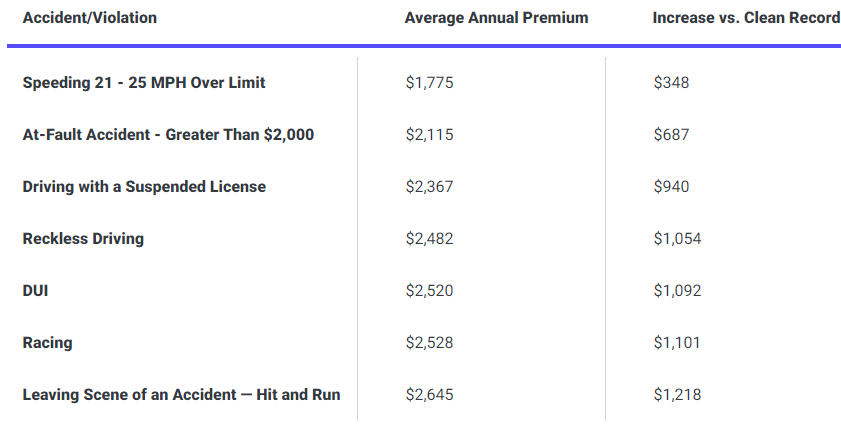

When it comes to car insurance, no one intentionally does something to increase their costs, but mistakes happen. However, many common violations drivers commit that end up increasing their costs are completely avoidable. Driving under the influence of alcohol or another controlled substance is such an easy one to avoid that ends up costing people the most. The same goes for speeding in excess or driving without a valid or on a suspended license. Drivers can easily avoid these violations with a little critical thinking and planning, yet they happen anyway and drivers pay. Below you will see a helpful chart provided by Zebra that shows the cost of Sr-22 violations.

Take-Home Message

Hopefully, you do not find yourself in need of or ordered to carry Sr-22 insurance. If you thought, the best chance you have to find a cheap rate is to shop online for quotes. A driver needing Sr-22 coverage may not have as many options, but that doesn’t mean they should settle. Find out what the cost of sr-22 insurance would be, and see how much you could save.